The most stable midpoint among U.S. exchanges

IEX midpoint executions are built for consistency and outperformance, backed by real midpoint scale. In Q3 2025, 90% of IEX midpoint volume remained stable versus 69% on other exchanges.* This stability is associated with better markouts, less slippage, and more competitive fill rates, as reflected in the metrics below. IEX captures 26% of all on-exchange midpoint volume and nearly half of all on-exchange midpoint block trades.

*Defined as midpoint trades where the NBBO does not change within 2ms after execution. Source: IEX Market Data, NYSE TAQ, Q3 2025

90%

26%

+48%

291%

1.3bps

42%

**Source: IEX data 2Q24 vs 3Q25

Block trading on IEX

Block trading on IEX has seen substantial growth across trade sizes, as institutions increasingly use IEX for midpoint and block interaction.

291%

254%

168%

170%

*Source: IEX data 2Q24 vs 3Q25

*Originated from IEX-classified Full-Service BD or Agency BD firms (IEX Exchange classifications are on a best-efforts basis by member firms’ trading sessions), D-Peg or Midpoint Peg, Not IOC or FOK (i.e., resting orders), at least as aggressive as the NBBO Mid on entry, Rested for 3+ mins or fully filled beforehand, MinQty <=1000, Order size $200k+, or 10k+ shares. Single-Stocks only.

How IEX’s protections support dark trading and midpoint stability

Why our midpoint is more stable

IEX dark orders benefit from IEX’s infrastructure protections:

Coupled with the designed protections of the Speed Bump and Signal, IEX non-displayed trading provides the type of adverse-selection protection that traders often seek in segmented dark pools, but within a single all-to-all exchange environment. This allows dark orders to interact with the full depth of IEX liquidity, avoiding the fragmentation or limited access that can come from limited-access trading models.

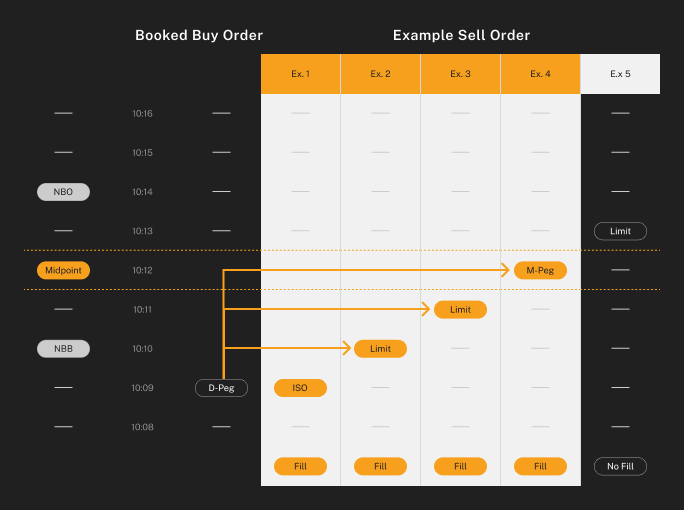

Example scenarios

Quote is stable. The Signal is "off."

The NBBO is $10.10 x $10.14. D-Peg buy order with a $10.13 limit is entered and booked at $10.09, one MPV below the NBB. The quote is stable.

- Example 1: ISO Sell order with $10.09 limit crosses the spread and executes with D-Peg order at $10.09

- Example 2: Sell order with $10.10 limit crosses the spread and D-Peg order uses $0.01 of discretion to trade at $10.10

- Example 3: Sell order with $10.11 limit expresses its full limit and D-Peg order uses $0.02 of discretion to trade at $10.11

- Example 4: Midpoint sell order with a $10.12 limit arrives, D-Peg steps up to the midpoint and buys at $10.12

- Example 5: A dark sell order with a limit of 10.13 arrives, D-Peg orders cannot execute at prices more aggressive than the midpoint; no trade occurs

Quote is crumbling. The Signal is “on.”

The NBBO is $10.10 x $10.14. D-Peg buy order with a $10.13 limit is entered and booked at $10.09, one MPV below the NBB. The quote is unstable.

- Example 1: ISO Sell order with $10.09 limit crosses the spread and executes with D-Peg order at $10.09

- Example 2: Sell order with $10.10 limit crosses the spread, but D-Peg order does not use discretion; no trade occurs

- Example 3: Sell order with $10.11 limit expresses its full limit, but D-Peg order does not use discretion; no trade occurs

- Example 4: Midpoint sell order enters, but D-Peg order does not use discretion; no trade occurs

- Example 5: D-Peg orders cannot execute at prices more aggressive than the midpoint; no trade occurs

%201.jpg)

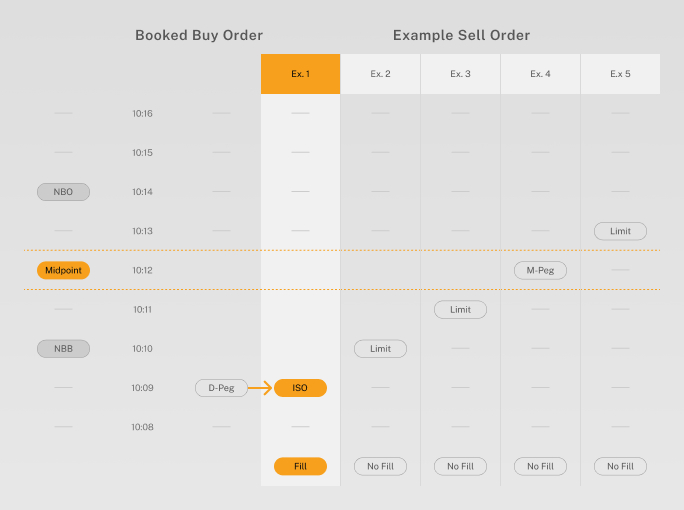

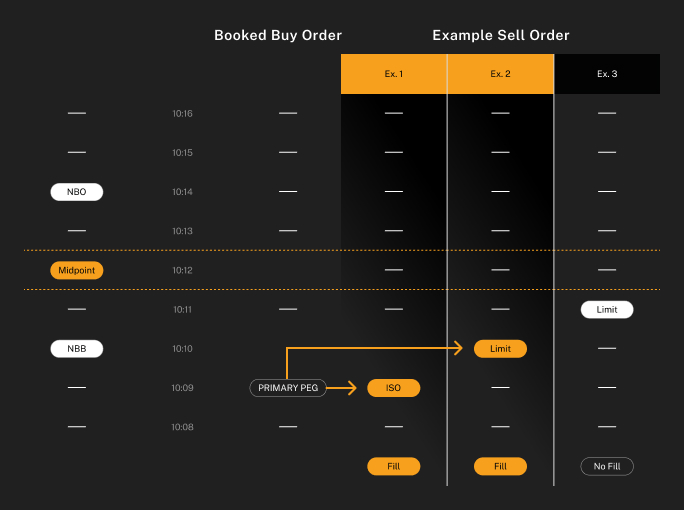

Example scenarios

Quote is stable. The Signal is "off."

Primary Peg buy order booked at $10.09, 1 MPV below the NBB. The NBBO is $10.10 x $10.14, during a period of quote stability.

- Example 1: Sell ISO with a $10.09 limit crosses the spread and executes with the Primary Peg order at its resting price of $10.09.

- Example 2: Sell order with a $10.10 limit crosses the spread and the Primary Peg order exercises price discretion to execute on the NBB at $10.10.

- Example 3: Sell order with a $10.11 limit enters but doesn’t trade with the Primary Peg order, because Primary Peg orders cannot execute at prices more aggressive than the NBB for buy orders (or NBO for sell orders); no trade occurs.

Quote is crumbling. The Signal is “on.”

Primary Peg buy order booked at $10.09, 1 MPV below the NBB. The NBBO is $10.10 x $10.14, during a period of quote instability (i.e., the quote is crumbling).

- Example 1: Sell ISO with a $10.09 limit crosses the spread and executes with the Primary Peg order at its resting price of $10.09.

- Example 2: Sell order with a $10.10 limit crosses the spread, but the Primary Peg order does not exercise price discretion while the Signal is on; no trade occurs.

- Example 3: Sell order with a $10.11 limit enters but doesn’t trade with the Primary Peg order, because Primary Peg orders cannot execute at prices more aggressive than the NBB for buy orders (or NBO for sell orders); no trade occurs.

.svg)

.svg)